Enric Duran Interview

28/09/2015

One of the pillars of the dominating troika system in the European Union is the threat that, for any country that leaves the euro system, they will find their substitute currency devalued, thus affecting the savings of the middle classes in those counties. Those middle classes typically being the ones who sway the vote in elections and therefore decide which political parties which are going to govern vente viagra paris.

As we have seen in Greece it is very difficult to open up the debate, with any possibility of it becoming generaly accepted, if you start from the proposal of leaving the euro. Experience, as the component lacking in the debate, makes it difficult to avoid the triumph of arguments based on fear. No country has ever left the euro, and therefore it is still not possible to demonstrate with facts that it would not prejudice the quality of life for the middle and lower classes. Clearly, there are countries within the European Union who decided at the time not to enter the euro, but none has take the inverse decision, once inside.

This brings me to another key point. In a society which has become used to the everyday advantages of the euro; that is, the realization of economic exchange within the greater part of Europe without the need to change currency, which always carries some cost to the consumer; it is difficult to open up the discussion over whether we would be better off with another currency if that currency is not also as European as the euro.

In this context, I feel that right from the start, there is a problem with the way we look at the issue. This problem is the result of two combined elements. One is the tendency we have in rational Western thinking of only looking at the options in terms of duality. To be in the euro or not to be in the euro. Shall I depend on the ECB, or not…? The other element is a general lack of knowledge in most of the population and also amongst politicians, journalists and many economists, regarding monetary questions and questions relating to credit. This is a significant obstacle for the economics that could bring about a possible currency that could break free from this duality.

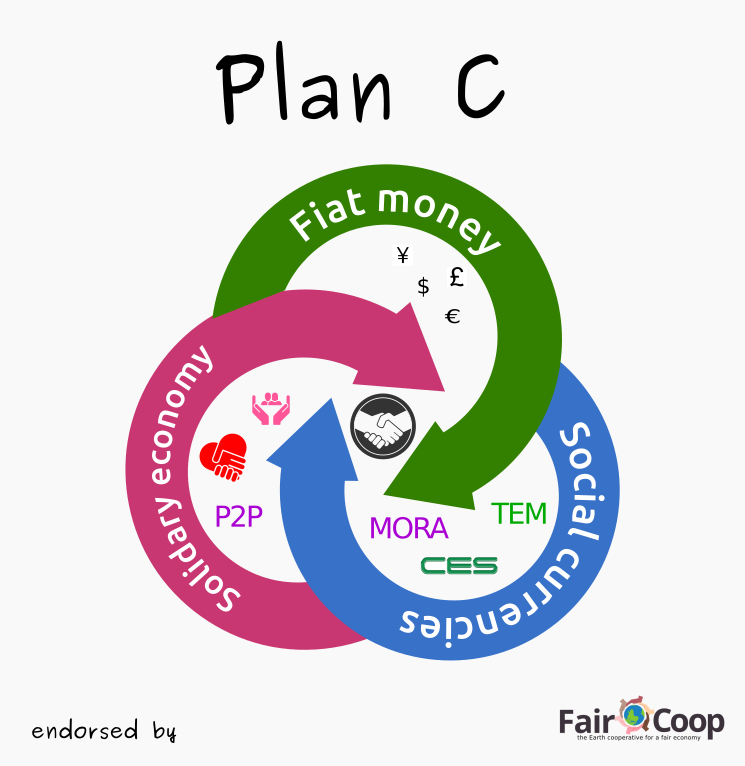

So, as far as the matter goes, I would like to contribute to the spread of this pending imaginative idea; to voice the possibility that there might exist a Plan C. This would be an option with the understanding that you can build a monetary system which allows peoples to generate a sovereign economy, and which would not be on condition that they separate from the euro either.

In reality, what is there holding us back from setting up a communal monetary system in the whole of Europe; one that could help build an economy centred around people? Maybe we are suffering from some mental block or other, but it is not real.

The infrastructure, the technology and the knowledge necessary in order to set up a new monetary system in the heart of Europe, are not only accessible to the various states, but are also currently in the hands of a multitude of protagonists in our civilian society.

The fact is that nothing is preventing the people, in the European countries that have the euro, from also using another common currency. And some are, in fact, using one – the Bitcoin – an example which demonstrates that it is feasible right now.

I acknowledge that the Bitcoin is not the best monetary tool for building a just and humanitarian economic system, but it does help make the road less tiring, and shows that other international currencies are not only possible, but are a reality. Some of us are learning to smooth this road with the addition of the Faircoin, and even though it might not be enough, it is helping us to understand how to make the technology behind it work in favour of social change.

You could argue that the likelyhood of gaining direct political activity for the entire population is extremely limited, if a new currency’s strength cannot depend on backing by the state. However, the purpose of this article is not the debate between state and self-government, and we can suppose that it might be desirable for a state to adopt it. So far so good, and if state adoption is still not a possibility, it is better to begin its development without state support than to be stuck with only the dualism of Euro – Drachma?

It is quite probable that, if there were a European monetary system common throughout Europe which did not depend on any state and that competed with the euro, that Greece would adopt it. At least the Greece of Spring this year would have. The Varoufakis Greece, to be more precise.

It is not unthinkable either, that in the context of Catalunya’s progress towards independence, that it might be important to have a sovereign monetary tool of this type in order to counteract the blackmailer temptations of the troika institutions, with the ECB at their head. And looking further ahead, in the future it would most likely be the only option in order to gain full sovereignty. To overcome the limited debate over whether to be in or out of the euro and the European Union, whilst generating the real possibility of reclaiming the common social rights of the inhabitants of Europe. No actual power could stop it happening.

So, it is not either out or in – quite the contrary.

For it to work, we would need to design a European (or global!) monetary system, with the same seriousness, rigour and practical use as the euro, but at the same time improving on the euro’s main defects. For example, this new currency could understand credit as a common good that ought to be guaranteed without interest, and instead of being created only by the banks, this money could be created in a decentralised way, linked to the productive activity of, and trust in local institutions and bodies belonging to the civilian society. A new currency, which in its functional DNA, would not allow supra-statal powers to take control of local economies.

If we could do it together, it would only be a matter of time before some state, or state project, would want to use it and then adopt it, even though they might need to find a judicial process in order to do it without competing with the euro or its official status, thus preventing the troika from throwing them out.

We can bring it about if we gather together the wide range of anti-austerity forces which already exist in the European Union. A bountiful and diverse aliance in which many might participate – from movements of the humanitarian economy to town councils. An aliance which might incorporate anticapitalist political movements, through to an entire local production network that survives despite to the corporate power.

Once we have recovered monetary sovereignty, with that by our side, nothing could stop us from travelling the road towards a socio-economic European community of the towns of Europe. A community that puts the co-operation and solidarity between human beings at the centre of our society and our lives.

Yannis Varoufakis and other radical European politicians on the left, are also suggesting something along these lines. Even though they have stated that democratisizing the euro is their first priority, they also recognize that they cannot exert enough pressure over the institutions of the EU, and therefore must stand by their independence and at the same time have the strength to rely on other currencies within the European ambit. For them, this is Plan B, but for others it could be Plan C – but call it what you like, the important thing is that from a very diverse range of ambits we aim to build this new monetary infrastructure for Europe, and now is the time to do it.

This post is also available in: Spanish Catalan Greek Italian